Why Brick-and-Click Retailers are Winning

According to the National Retail Federation (NRF), total sales during the Thanksgiving weekend in 2014 decreased by 11 percent compared to the same period in 2013. However, online sales during the same period grew by an average of 20 percent. At first glance, one could jump to the conclusion that online shopping is replacing offline shopping at an incredibly fast pace, but a deeper look into the data for online shopping during this period shows us that brick-and-click (B&C) retailers, or those with both physical and online stores, are the ones driving most of the online sales growth. It seems that online shopping is not replacing offline shopping—instead, the two are complementing each other.

According to the data we collect at the Adobe Digital Index, the average B&C retailer grew an average of 25 percent during the Black Friday weekend, compared to 10 percent for the average online-only retailer. Since we are talking about the average retailer, it is important to note that there were B&C retailers with growth rates lower than 10 percent, and online retailers with growth rates higher than 25 percent—but, on average, B&C retailers grew at much higher rates than online-only retailers.

Our data suggests a few reasons as to why B&C retailers are growing at such fast rates. The first one relates to the fact that most B&C retailers have strong brand recognition, which they have acquired through decades of operation. If you spent years shopping in-store at Walmart or Target, it is likely that those names will come to your mind first when thinking of where to buy something online. We can see this in the fact that, on average for 2014, 51 percent of visitors went directly to B&C retailer websites, compared to only 39 percent of visitors for online-only retailers.

Our data also shows that customers take advantage of ship-to-store when it is offered by B&C retailers. On a typical day, the average retailer offering ship-to-store fulfills 16 percent of its orders using ship-to-store, and the number generally increases on weekends and major shopping days. This gives these retailers an incredible advantage in satisfying a customer’s need to have the item now instead of waiting days or weeks for it to be delivered through the mail. With B&C retailers, customers can spend time browsing from the comfort of their couches before hopping in the car to pick up the item at the store. If they do not like what they see, they can simply return their purchases while at the store without having to worry about shipping labels and long lines at the post office. If there is a problem with the order, customers can complain to a real person, instead of having their messages put in a queue to be answered who knows when.

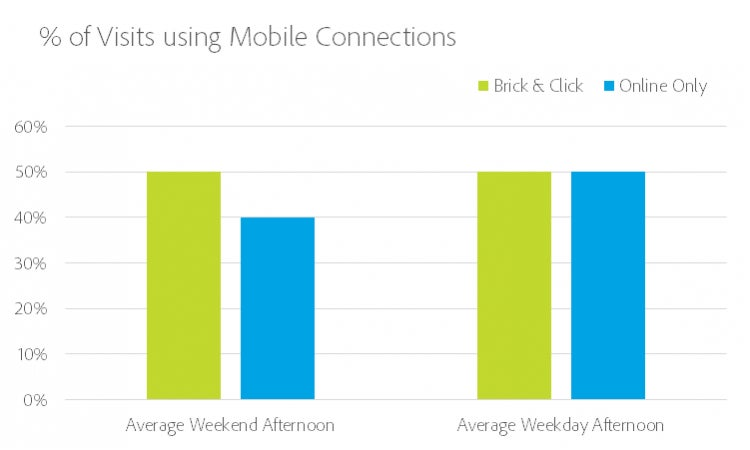

It seems that, more and more, customers want to have the online and offline worlds connected. An important example is the online browsing that happens while customers are inside of stores. Our data shows that during weekend afternoons (which are traditionally dedicated to in-store shopping), B&C retailers have a significantly higher percentage of visits from users using their mobile connections than online-only retailers do. This difference is not true during weekdays. This could indicate that shoppers are indeed using their mobile devices and searching for products online while shopping in physical stores. Not only that, it indicates that costumers are browsing B&C retailers’ websites at higher frequencies while they are shopping in physical stores. These consumers want to buy right now, so, while they are inside of a certain B&C store, they browse another B&C store’s website to see if that store has the same product, at what price, in what quantities, and so on. B&C retailers have the perfect opportunity to satisfy these consumers and connect the online and offline worlds.

http://blogs.adobe.com/digitalmarketing/wp-content/uploads/2015/01/L.Maykot_02-e1420659416314.png

That being said, there is still much more that these retailers need to do in order to maintain and increase their high sales growth rates. Unfortunately, as of now, very few B&C retailers take advantage of iBeacons, which could exponentially connect online and offline worlds. Although most B&C mobile apps limit themselves to providing customers with more information about products, offering reviews, product availability and location, and sometimes even price comparisons, they can and should do more. Why not give customers shopping in the store’s cooking section a specific coupon for a food-related product, or a list of the top-rated cooking tools based on costumer reviews? B&C retailers need to use more online capabilities to improve offline shopping, and more offline capabilities to improve online shopping.

While there were worries years ago that online shopping would substitute brick-and-mortar shopping, it seems brick-and-mortar retailers kept that from happening by transforming themselves into B&C stores. And they have seen significant gains. While online-only retailers can satisfy the human desire for convenience, they seldom satisfy our desires for instant gratification—we want things now. B&C retailers can satisfy our need for convenience and instant gratification, and they have seen impressive growth rates because of this ability. The question remains, however, of how much they will expand their advantage in the years to come by connecting the online and offline worlds.