ADI: Holiday 2016 Unwraps New Online Shopping Behaviors

Late-season shopping drove an 11% increase year-over-year in online revenue, for a grand total of $91.7 billion.

The 2016 holiday season couldn’t have ended on a happier note, with retailers watching $91.7 billion in online revenue flow in, for an 11% increase year-over-year.

To no one’s surprise, three days that stood out among the rest were Thanksgiving, Black Friday, and Cyber Monday, with Black Friday and Cyber Monday each exceeding $3 billion in online sales. What was surprising, however, is that Black Friday online sales grew the most (21.6% YoY), while Cyber Monday’s sales grew just 12.1% YoY. At that rate of closure, Adobe Digital Insights (ADI) expects Black Friday to surpass Cyber Monday in online sales this year.

According to ADI, search boosted Black Friday performance. Search advertising spend increased 16% YoY on Black Friday, compared with just 5% on Cyber Monday, when cost-per-clicks happened to be 7% higher than Black Friday. As a result, impressions on Black Friday increased 20%, while Cyber Monday decreased by 2%. Advertisers who put money toward search ads on Black Friday were able to more efficiently land folks on their websites and get them to transact.

ADI also found that 57 days of this holiday season exceeded $1 billion in sales, up from 53 last year.

“ADI was right on the money this year,” said Becky Tasker, managing analyst at ADI. “We predicted $91.6 billion in online sales. When we dug in to figure out what caused the growth, we found it was driven by late-season shopping, which we also predicted.”

Indeed, large increases were seen around shipping cut-off time frames, according to ADI. In total, the $25 billion revenue mark was hit around the same time as in 2015, yet the $75 billion revenue mark was hit six days earlier in 2016, indicating increased spend later in the season. Revenue in the seven days in the last half of December grew by more than 20%, and Dec. 19, the last Monday before Christmas, turned out to be a big money maker as well, according to ADI.

ADI’s analysis also uncovered that shopping behaviors changed after the Black Friday/Cyber Monday hoopla. Customers bought their big-ticket items on Black Friday and Cyber Monday, and then last-minute and one-off gifts later in the season, perhaps realizing they had forgotten someone. Once Cyber Monday was over, conversion rates increased and average order value decreased until it was too late to ship in time for the holidays.

“One method of extending the holiday season that retailers should consider for 2017 is click and collect,” Tasker said. “We saw a decrease in conversion rates up to the point where it was too late to receive online orders in time for Christmas. If retailers were able to promote features that encouraged conversion to stay steady, it could generate another $2 billion in revenue for the 2017 holiday season.”

Of course, smartphones played a role in holiday shopping, ADI said. Smartphone traffic for the season was at 41%; however, conversion still lagged that of desktops. Smartphone conversion was highest on Cyber Monday, at 2.8%, but still 26% below the desktop season average of 3.6%, ADI found. Desktop visits converted at 2.4 times the rate of smartphone visits, indicating that consumers still relied on their smartphones to research and then opt for the desktop to transact. It’s a $4.5 billion opportunity cost, according to Tasker, who said marketers need to work harder at getting people to transact via mobile.

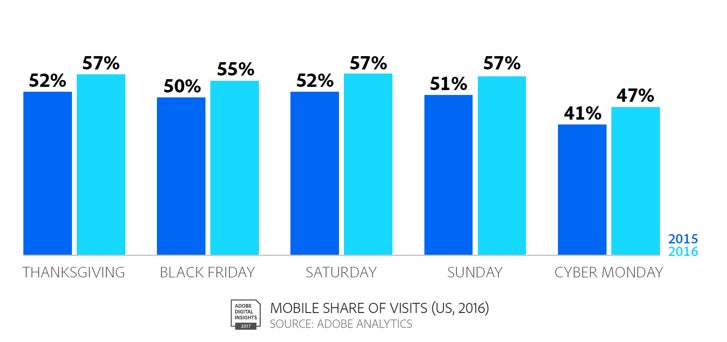

That said, ADI noted an increase in mobile usage throughout the holidays, even on key shopping days such as Thanksgiving and the Saturday and Sunday immediately following Black Friday. Traditional holidays, such as Christmas Eve and Christmas, remained heavily mobile yet some of the lowest revenue-generating days.

While desktop still wins in conversion, mobile share of revenue did increase. Between Thanksgiving and Cyber Monday, for example, mobile share of revenue increased 16% YoY to an average of 36%.

“We found that smartphone visits remained less valuable than desktop visits during the holidays, causing a drag on potential revenue, especially as visits increased,” Tasker said. “During consumers’ planning phase of holiday shopping—roughly Nov. 1 through Nov. 23—websites that grew the most saw more than half of their traffic come from mobile devices. Then once the major shopping weekend hit, the mobile gap disappeared and both websites that grew vs. those that didn’t tracked the same share of mobile traffic.”

Furthermore, ADI found, only 40% of retailers experienced above-average growth on the two biggest shopping days of the year: Black Friday and Cyber Monday. Those that grew averaged 48% revenue growth, while the remaining 60% saw an 8% decline. This appears to indicate that the Internet has reached saturation and growing websites stole share from the others, Tasker pointed out.

View the full report below or click here to see a larger version on SlideShare.