As Online Prices Increase, Consumers’ Purchasing Power Declines

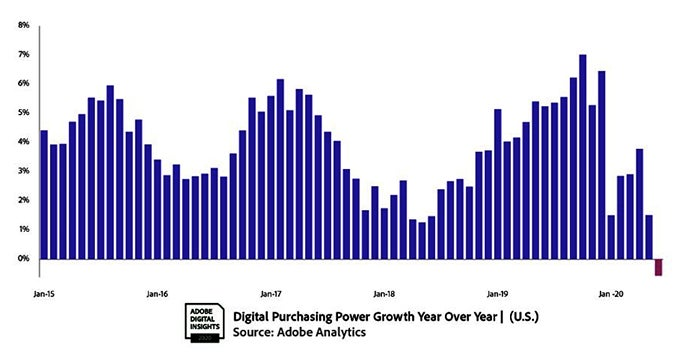

If June is any indication, what consumers didn’t spend in the first half of 2020 could cost them in the next six months. According to Adobe’s June Digital Economic Index (DEI), consumers are getting less for their online dollars for the first time since the company began tracking digital purchasing power (DPP).

“The first six months of 2020 saw online prices plummet. With apparel, for example, the price drops in March and April are the biggest on record, likely because of early clearance discounting and lower demand for certain types of clothes due to the pandemic,” says Vivek Pandya, digital insights manager at Adobe. “But now prices are picking back up – at a time when they usually go down. This, along with inflation in other major shopping categories, has depressed how much shoppers can get for their money online.”

Online sales growth begins to plateau

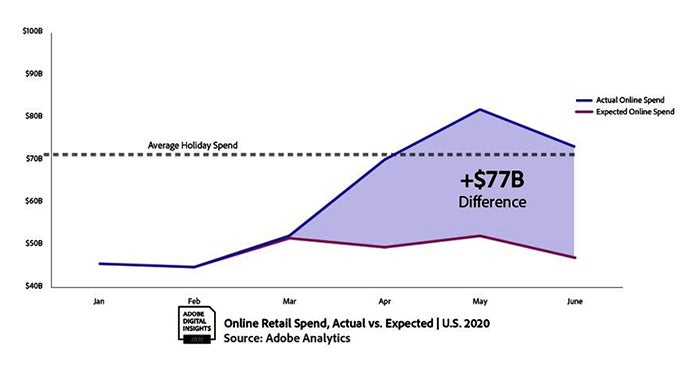

COVID-19 shelter-in-place mandates and store shutdowns are likely behind many of these atypical ups and downs, though seasonal trends still apply. For example, while total online spending of $73 billion in June marked a 76.2 percent increase year-over-year, it was down from May’s $82.5 billion – a decrease that, in general, is typical at this time of the year, according to Pandya.

“Yet spend is still accelerated for what we tend to see if we were in a non-COVID environment,” he adds. “Just like the April-to-May 2020 time period, spend is still tracking above 2019 holiday season levels.”

Online prices elevate

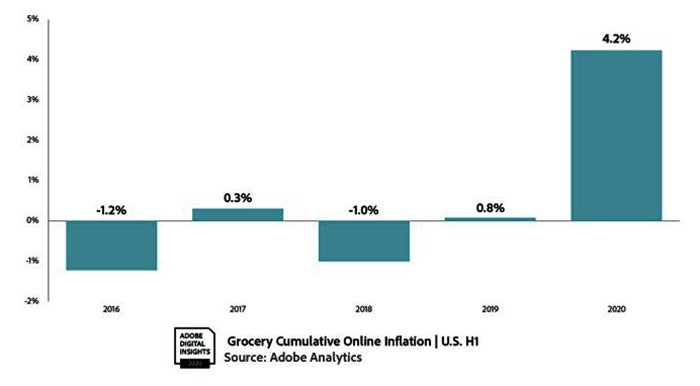

Meanwhile, although prices for online groceries increased by only a half-percentage point in June, they are still high for this time of year, according to the Adobe DEI, which, powered by Adobe Analytics, is based on an analysis of aggregated and anonymized data from 1 trillion visits to retail sites and over 100 million SKUs from 80 of the top 100 U.S. retailers.

Grocery prices typically increase more in the second part of the year, around the holidays, Vivek explains. But because of COVID-19-related factors, inflation on groceries surged 4.2% from January through June – a 500% increase (over average cumulative inflation levels for the same time period) as demand shot up for suddenly hard-to-find products.

“It will be interesting to see what unfolds as people feel more comfortable buying in stores again,” Vivek says. “We’ve always thought of the online marketplace as a ‘value marketplace’ for consumers, meaning consumers can get a bit more bang for their buck, and this is supposed to be a more favorable time of year for them in terms of prices. But they aren’t getting that relief.”

Computer prices, too, have been on the rise, up 6.2% since March and “wiping out price decreases the category experienced since June 2019,” Vivek notes. “But that increase is now slowing as we see in June, back to pre-COVID levels, with less than 1 percent year-over-year growth.”

Back to the apparel category, deflation in prices for the first half of a typical year is around 4 to 6 percent. But this year prices dropped much more — down 13 percent. A slowdown in shopping pushed retailers “to do a lot of that early liquidation they save for the summer to move inventory and make it favorable for people to purchase clothes,” according to Vivek.

“It will be telling as we walk into the back half of the year to see whether retailers will be able to offer discounts or whether they will have to make up for these big price-margin shifts during the first six months of this year,” he says.

Consumer behavior reflects COVID-19 attitudes

A likely sign of shoppers getting antsy to get out more and feeling better about visiting physical stores can be seen in a decline in the number of buy online/pickup in stores (BOPIS) orders placed. June saw a 21 percent decrease in BOPIS orders over May – though that’s still a 130 percent increase year-over-year.

“Stores have been reopening, so people are returning to a more hybrid space in terms of still using BOPIS but also resuming in-store shopping like they did pre-COVID,” Vivek says. “But that’s not to say we’re anywhere near normal in-store engagement.”

DEI analysis also showed a “persistence” in customer loyalty, Pandya says. While spending among new online customers and one-time shoppers slowed in June as compared with May, it held steady among loyal shoppers, defined as those who have made two-plus purchases.

“That’s a positive story for retailers, representing a successful customer journey for people who are moving online and are continuing to shop online,” Pandya says. “It’s a testament to good digital experiences and being able to deliver on the customer’s needs.”

Click here for more insights from Adobe’s Digital Economy Index.

At Adobe, we believe that everyone deserves respect and equal treatment, and we also stand with the Black community against hate, intolerance and racism. We will continue to support, elevate, and amplify diverse voices through our community of employees, creatives, customers and partners. We believe Adobe has a responsibility to drive change and ensure that every individual feels a sense of belonging and inclusion. We must stand up and speak out against racial inequality and injustice. Read more about the actions we’re taking to make lasting change inside and outside of our company.

We also know many people are still impacted by the current COVID-19 crisis and our thoughts are with you. The entire Adobe team wants to thank you, our customers, and all creators around the world for the work you do to keep us inspired during this difficult time.