5 COVID-19-driven video content consumption trends to watch

Image source: Adobe Stock / tomertu.

COVID-19 has changed everything from the way we work, to the way we shop, and it’s even impacting the content we consume online.

Indeed, research from Adobe Digital Insights, which uses Adobe Analytics to analyze over 24 billion video starts and over 6.6 billion hours of video content viewed online across OTT, desktop and mobile phone platforms, has uncovered some interesting behavioral patterns when it comes to video consumption in the U.S. The analysis, coupled with a complementary survey of 1,043 U.S. adults conducted in July, points to the following five trends for marketers to watch.

1. Video content binging tracks with stay-at-home orders

After months of binge-watching video content, consumers were just starting to dial back, and then July came around.

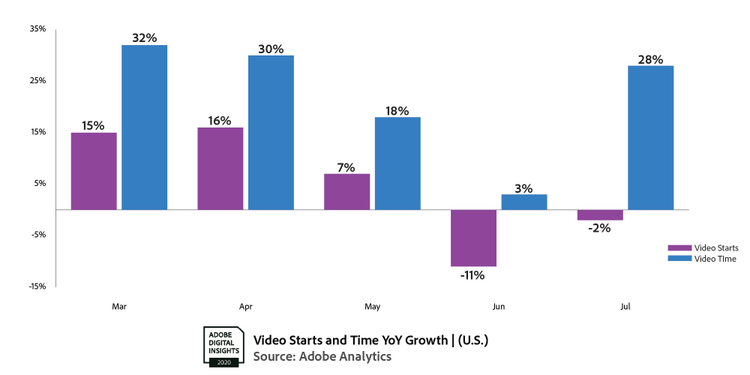

Publishers are seeing the effects of shelter-in-place orders, starting in March, with surges for both video starts and time spent that month. By June, consumers began to dial back consumption as states began to re-open and the COVID-19 curve began to flatten.

Then July rolled around and while video starts were still down, which indicates less content surfing and less net-new viewers, time spent is back up to March levels. “This surge up in July could very well have something to do with the fact that many states have seen a re-emergence of COVID-19 cases, with many shutting down shortly after opening up,” says Vivek Pandya, senior digital insights manager, Adobe.

2. Consumers are completing videos more often

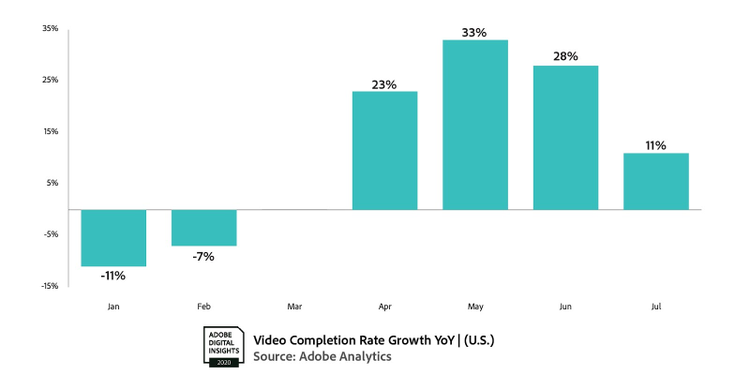

Video completion rates began a steady decline in early 2019, as consumers were flush with a growing array of services and original content to consume. By the start of 2020, completion rates were still down.

However, the growth in video completions that began in April has maintained through July, which saw significant growth at 11 percent YoY.

Consumer survey data further cements this notion, as it found that 63 percent of consumers say that they always/often finish a piece of video content from start to finish in a single sitting.

“Completion rates are a really powerful indicator for evaluating advertising and content development strategies, as they have a significant impact on the performance of ads attached to video content and showcase the video’s ability to hold the viewer’s attention,” Pandya said. “As we move into this final quarter of 2020, it’ll be interesting to see whether these rates continue to stay up, as more normal viewing dispositions return, and how advertising strategies may shift as a result.”

3. OTT is growing, but mobile takes a hit

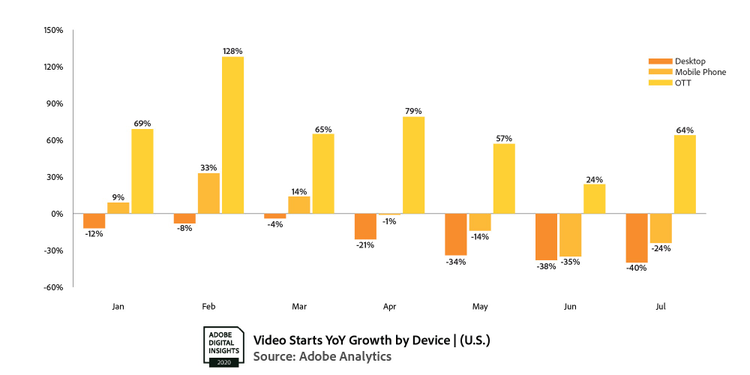

Before COVID-19 mobile video consumption was seeing steady growth, as mobile devices became more advanced and video content was aplenty.

“Mobile video was an opportunity area for content providers in the beginning of 2020, but shelter-in-place orders have shifted that significantly,” explains Pandya.

While data from Adobe’s Digital Economy Index shows growth in areas like mobile shopping, consumers are not using their devices to watch video. In fact, over the top video (think: Hulu, Netflix and Disney +) has been the primary growth driver of video consumption in recent months.

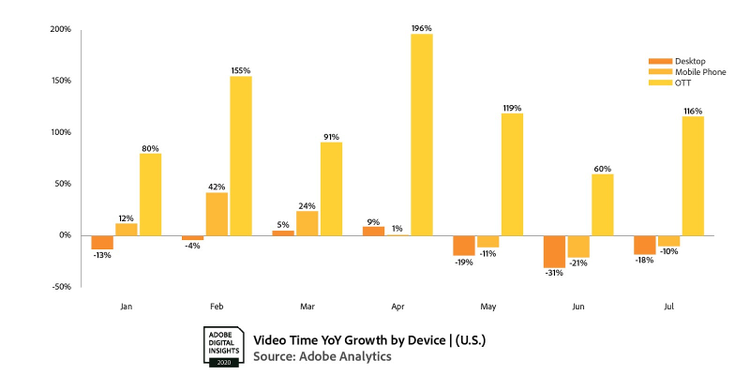

/When analyzing video time spent, the data paints a similar picture: OTT is the primary growth driver, with significant peaks in months like April.

Pandya adds, “time spent on mobile has been in decline for the last three months (May-July). And while desktop had an unexpected spike in June, it has not been a growth driver in the same way OTT has.”

4. News content takes the lead, followed by movies

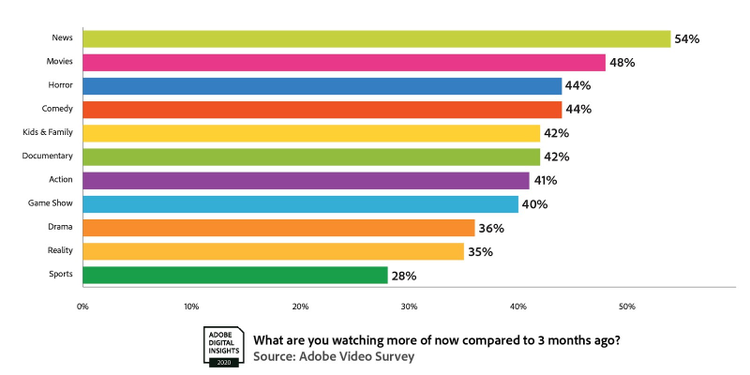

In the consumer portion of this research, more than half (54 percent) report watching more news now compared to just three months ago, followed by movies, horror, comedy and kids/family. Additionally, 59 percent of respondents say they enjoy having new release movies available on-demand (at the same time they would be available in theaters).

5. Too much content

Although consumers have spent a lot of their time quarantined with video turned on, 40 percent feel overwhelmed with the amount of choices they have in selecting programming. The study finds that 40 percent felt there were too many apps and services to stream video, and that it was difficult to manage (29% did not agree; 31% were neutral).

But that could just be because people are subscribed to a number of different services, Pandya says, pointing to the fact that 60 percent of consumers surveyed report having one to three services, while 35% had between four to seven. Around 6% had more than eight.

“If there’s one lesson overall that COVID-19 has taught us about content, it’s that digital video is playing a more permanent role in the everyday lives of consumers today, and that’s not going to change—not even post-pandemic,” Pandya says. “Now, that doesn’t mean that all marketers need to go out and just start creating a whole slew of video content. On the contrary, we are encouraging companies to focus on quality over quantity when it comes to video content, with a focus on what consumers want, need and like to consume.”