Strengthening the marketing-IT partnership for greater digital success

“We’ve entered the decade of the CMO and CIO partnership.” That’s according to Adobe CEO, Shantanu Narayen, in his keynote address at this year’s Adobe Summit, where he talked about the fact that marketing has become more technology and data-driven, and IT more customer-focused.

The need for greater collaboration between IT and marketing is much needed in the financial services industry. In fact, it’s essential to the digital transformation journey.

To better understand the state of this critical partnership, Omdia and Adobe recently surveyed more than 300 marketing professionals and technologists in financial services firms. From their responses, we can see where marketing and IT are already aligned as well as where differences remain – and we can understand what it takes to develop a successful marketing-technology partnership that can strengthen customer engagement across digital channels.

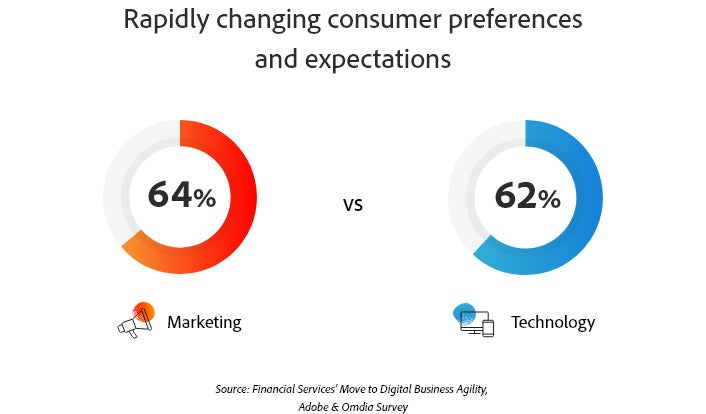

Meeting customer expectations is the top priority for both marketing and IT

According to 64% of marketers and 62% of IT professionals, rapidly changing consumer preferences and expectations are a primary driver of disruption within the financial services industry. Likewise, both roles believe that launching new digital offerings and focusing on digital customer engagement is the top strategic priority to being able to meet customer expectations.

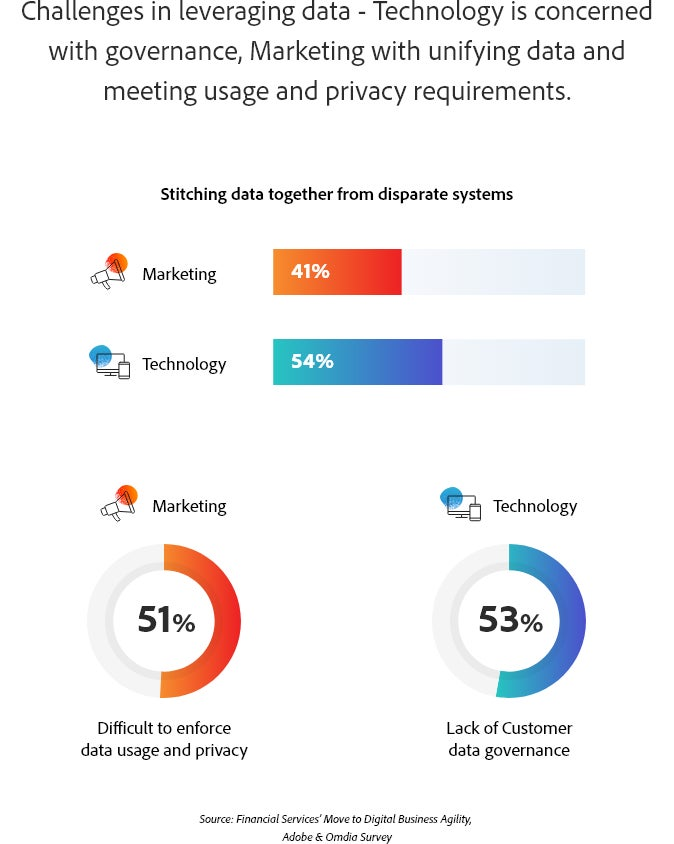

Having access to real-time data is a critical component of developing the business agility financial services firms need to meet consumers’ demands. Yet, while both marketing and IT believed the ability to unify data is essential, they acknowledged that challenges remain in stitching data together from disparate systems.

Before embarking on a five-year digital transformation roadmap, online broker TD Ameritrade was facing these same issues. The organization underwent an extensive audit from a marketing technology and data standpoint, identified the gaps, and laid out what needed to be done to fill those gaps.

“We were making a case for how these technologies would not only make us a more modern marketing department but also make us a more effective marketing department. And more effective meant creating an ecosystem that could deliver scalable personalization across marketing channels and connected experiences, allowing us to maximize revenue potential and client satisfaction,” says Chris Kienle, managing director at TD Ameritrade, who was tasked with bringing marketing and technology teams together to facilitate this aspect of its digital transformation.

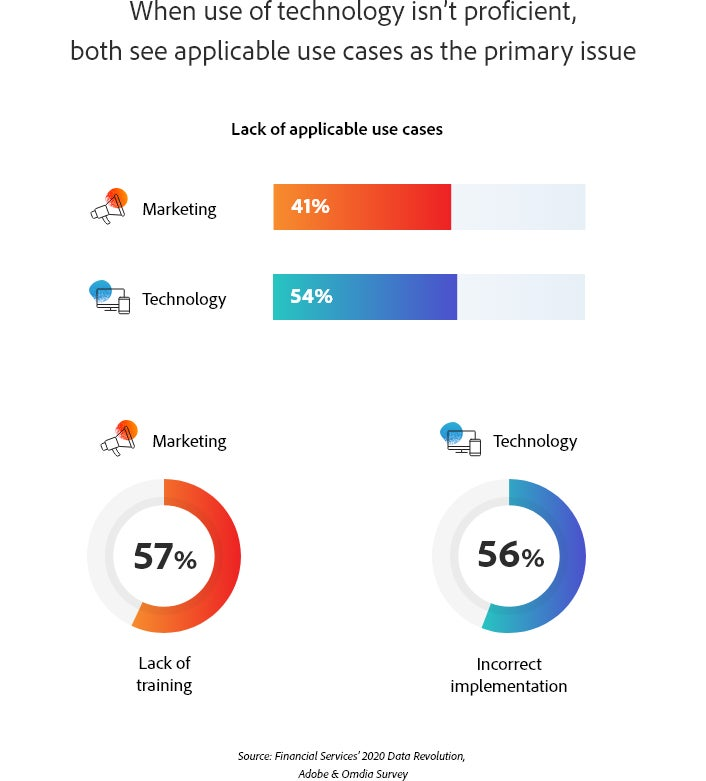

Matching use cases to technology initiatives is a requirement for success

When it comes to investing in technology to achieve digital transformation and business agility, both marketing (57%) and IT (59%) agree that a lack of applicable use cases is the primary reason the use of technology isn’t proficient within an organization.

It’s a common problem. Many people that come to us believe they have a technology need, then go out and purchase that technology without thinking through how it’s going to be used. Instead, they should be asking, what is the business issue that the technology is solving for, and how is it going to drive value for the company?

At TD Ameritrade, Kienle helped the marketing team define the use case for a technology purchase. Instead of saying to IT, “we want the new CMS technology because it’s new and we need it,” Kienle helped marketing talk through the capabilities they needed and what they were trying to achieve.

“If we spend all this money, what are we going to get for it? Our marketers needed answers to those types of questions,” says Kienle. But as someone who came from IT to marketing, he was able to speak both languages and could help the technology folks understand what marketing was trying to achieve with a new technology purchase.

For financial services firms to maximize the value and use of technology, it’s important to have agreement on how the technology is going to be used, how it’s going to drive value, and then ensuring that it’s implemented correctly and that users get trained on how to use it.

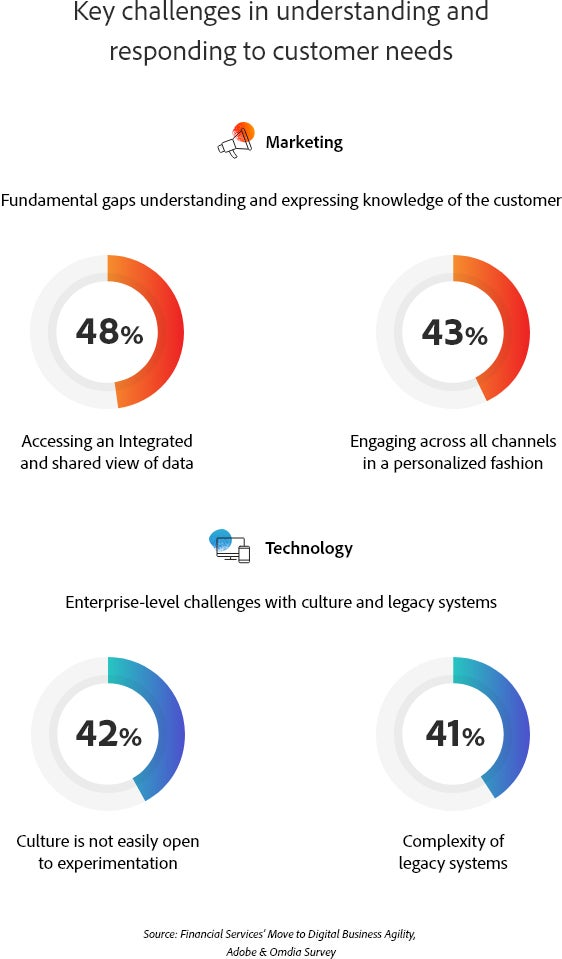

Overcoming organizational challenges is necessary to close the capabilities gap

While IT professionals may want to enable marketing to deliver on the promise of a better, more personalized customer experience, many of them acknowledge that the IT culture isn’t necessarily open to experimentation. Legacy systems can also make it challenging for IT to help marketing respond to customer needs.

To close the capabilities gap and be responsive to customers, both marketers and IT believe that the right organizational structure needs to be in place. However, they had different perspectives on what organizational structure was necessary.

For TD Ameritrade, having the right organizational structure was a key component of being able to move their digital transformation forward. “We needed to change the way we worked. We needed to be more nimble. You have to have this multi-pronged transformation of people, platforms, and processes,” says Kienle.

He also noted how vital having executive support and buy-in was to the process. “When our CMO understood the value of technology and data to the marketing organization, and our CIO understood how important technology and data was to a marketing department, they created the conditions for success,” says Kienle.

“The more the technologists understand how the work they do is used and how it supports the marketing mission and strategy, the better they’re going to be at their jobs,” says Kienle. “And the more our marketers understand the work that the technologists have to do to stand up this technology and add capability, the more you’re going to have empathy in both directions and a team that feels like one team.”

TD Ameritrade, Inc. and Adobe are separate unaffiliated companies and are not responsible for each other’s services or policies.