Three imperatives the manufacturing industry can’t afford to ignore

The early days of the 2020 pandemic put the United States in wartime posture as the future appeared as opaque and uncertain as the days following 9/11 and other global-scale crises. Industrial titans mobilized to meet shortages for the healthcare industry by rejiggering production lines to produce hand sanitizer, face coverings, ventilators and other life-saving equipment.

General Motors, for instance, partnered with Ventec Life Systems to make good on its pledge to deliver 30,000 critical care ventilators to the U.S. Department of Health and Human Services in just a matter of months. The agility and determination these two companies used to solve supply chain and manufacturing challenges to accelerate the production rate to previously unimaginable levels offer a textbook lesson for solving mutual challenges through open collaboration. It is also a testament of innovation for an industry already bruised by trade wars and disruption.

Similarly, across the pond, RS Components, which is a global supplier of industrial components, met the plea of doctors in the U.K. calling for respirators to treat COVID-19 patients. The company set up 3D printers in hospital car parks and began manufacturing essential respirator parts on-site for immediate use.

That spirit of innovation is now prevalent across the industrial manufacturing community as the health and financial crisis has essentially forced a total review of value chains to meet customer demands. Industry 4.0 or “smart manufacturing” moved from novelty to mantra to mandate. Firms are connecting industrial equipment to the cloud, ensuring interoperability between modern and legacy systems, building autonomy into workflows along with digital twins and evolving digital capabilities faster than the pace in 2019 or any previous year. This could be part of the reason why in October, in the U.S., the manufacturing industry recorded its strongest growth in two years.

As the year draws to a close, review and planning meetings are probably popping up on your schedule. Now is as a good a time as ever to take a close look at your digital and data challenges and how to overcome them.

There are three main industry challenges that existed prior to COVID-19 that are now critical:

As physical interactions are now a health hazard for many, most people have significantly increased their reliance on ecommerce and digital self-service.

Manufacturers, as in other B2B-heavy industries, have long relied on face-to-face interactions as critical steps and touchpoints in the buying process. Sales teams invest heavily in conferences, demonstrations, site/product inspections, and physical sales meetings to connect with new customers, deepen relationships with existing customers, and generate business. When the pandemic hit in full force and in-person meetings were immediately obsolete, many manufacturers were left wondering about the future of their business models.

“2020 has been a wake-up call for many manufacturers who are quickly adapting to future-proof and crises-proof their business models,” says Jeff Hennige, head of digital strategy, manufacturing at Adobe. “After years of head nodding around the importance of digital, many of our clients have accelerated initiatives such as e-commerce deployment to ensure business continuity or to take advantage of increased demand.”

Those that had invested in digital quickly pivoted their customers and sales processes to digital channels. With digital capabilities in place for years, they have a robust ecommerce experience, sophisticated marketing automation practices, and nimble customer communication strategies. By activating their digital experiences these brands not only replaced traditional face-to-face interactions but enriched the customer experience with personalization through account-based marketing, streamlined transactions through ecommerce and digital documentation, and reduced call center strain through digital self-service.

Honeywell was one of these companies that had prioritized digital innovation. Honeywell not only invested in improving their digital experience, but also saw potential new streams of revenue in digital. To capture more market share (and mind share), Honeywell launched a marketplace dedicated to digitizing trade of aerospace and aircraft parts. In an area where less than 2 percent of transactions occurred online, Honeywell saw the opportunities to connect new buyers to these sellers. Honeywell launched their marketplace in just 12 weeks and immediately saw the appetite for what they had created with one individual researching and executing a $100,000 purchase just minutes after registering.

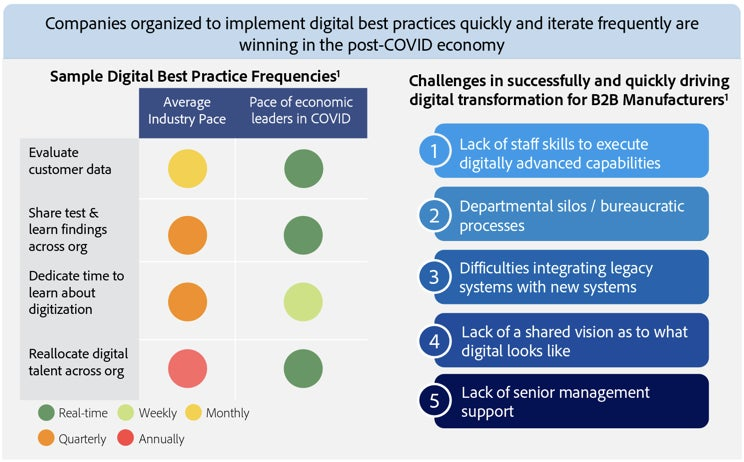

Manufacturers need the greatest possible agility to advance digitalization and continually collaborate in new ways.

The solution is more cultural than technological. Leaders need to champion a digital vision that increases the speed of decision-making across the entire organizational culture. They need to drive internal efficiencies with new or fully utilized digital tools and adapt quickly to shifting go-to-market strategies, messaging mandates, and customer priorities. Agility, or lack thereof, was front and center at the outset of the crisis. Every organization needed to quickly pivot messaging, create new content addressing customer and employee concerns, and implement new campaigns at a moment’s notice. Roadblocks, choking points, and limitations became immediately apparent.

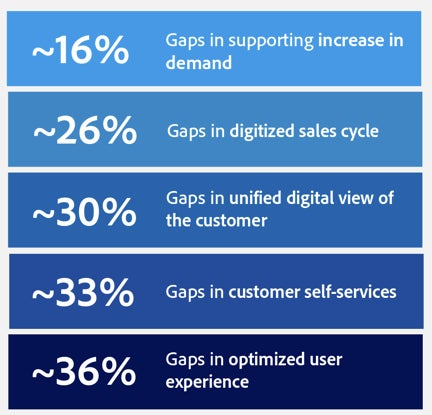

Despite COVID-19’s financial dents to OPEX and CAPEX, manufacturers need to invest in technologies that support customer-facing digital projects for recovery and growth.

Modernization is the key for meeting the challenges the current environment. Digital champions can identify system and data gaps that align to sales, develop an end-state technology roadmap, and evaluate Total Cost of Ownership & ROI of investments. Panduit invested in technology for short- and long-term impact.

According to Hennige, manufacturers are often described as digitally immature, but historically they’ve been leaders in technology and innovation. “They have just directed their efforts to areas like Industry 4.0 and digital factories. They can now lean into these strengths and apply mature practices like process design and Six Sigma for customer-facing digital capabilities to thrive in the new digital-first world,” asserts Hennige.

Manufacturers, whether desired or not, have been pushed into the digital world. For organizations that were prepared, this was manageable, for others it was stressful. Regardless, many of these changes and shifts are here to stay. The benefits of digital are tangible – enhanced customer insights, improved customer satisfaction, increased efficiency and agility, and informed business operations.