Adobe Digital Economy Index: COVID-19 Delta variant derails airline recovery

Image source: Adobe Stock / jovannig.

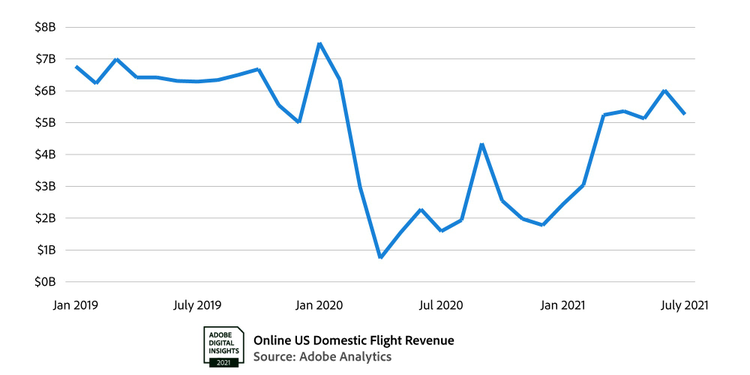

At the start of 2021, an increase in COVID-19 vaccinations and consumer confidence began to release pent up demand for air travel. By June, U.S. consumers had spent $6.0 billion in domestic flights, only 5 percent below 2019 levels. The sudden rise of the COVID-19 Delta variant has all but blunted the path to recovery. Adobe is issuing today the latest data and insights from its Digital Economy Index.

Domestic flight bookings in July 2021 drove $5.26 billion in online spend, 16 percent below 2019 levels (compared to July 2019 spend). This represents a 13 percent decline from the month prior (June 2021, $6.0 billion). From January through July 2021 (year-to-date), a total of $34 billion has been spent so far, down 28 percent compared to the same period in 2019.

In the first three weeks of August, flight bookings continued to decline at an even more aggressive pace. From August 1 - 21, $2.9 billion has been spent online for domestic flights, which is 33 percent below the same period in 2019.

“Domestic flight bookings in August thus far show that U.S. consumers are taking the Delta variant seriously and once again shifting their travel plans,” says Vivek Pandya, lead analyst, Adobe Digital Insights. “At the current rate, we expect spend in the month of August to be significantly under July. These two months historically have similar spend levels, once again showing that like in 2020, the pandemic will continue dictating the terms.”

Flight prices continued to increase in July, which is the first month of 2021 where prices were back to 2019 levels (compared to July 2019 prices). In the first three weeks of August, however, as demand waned, prices have gone down and are 6 percent below 2019 levels. For historical reference, June 2021 prices were 1 percent lower vs 2019 (May: 8 percent lower — April: 13 percent lower — March: 17 percent lower — February: 26 percent lower — January: 28 percent lower).

Looking ahead to Labor Day weekend, spend on domestic flight bookings is down 16 percent compared to Labor Day weekend 2019. For those traveling, the top 10 domestic destinations (per arrival sites) include: Bozeman, MT — Kailua-Kona, HI — Kahului, HI — Honolulu, HI — Orlando, FL — Las Vegas, NV — North Charleston, SC — Phoenix, AZ — Reno, NV — Denver, CO.

The top 10 destinations for the Summer season overall include: Key West, FL — Bozeman, MT — Kahului, HI — Kailua-Kona, HI — Las Vegas, NV — Honolulu, HI — Fort Myers, FL — Phoenix, AZ — Orlando, FL — Nantucket, MA.

Methodology: The Adobe Digital Economy Index offers the most comprehensive set of insights of its kind, based on analysis through Adobe Analytics that covers over 150 billion visits to travel, leisure and hospitality sites — measuring transactions from 6 of the top 10 U.S. airlines (more than any other technology company).

For additional research reports on the digital economy, as well as resources for putting the customer first in a digital-first world, visit Adobe’s Digital Economy Hub.