Adobe and Mastercard solutions accelerate digital payouts

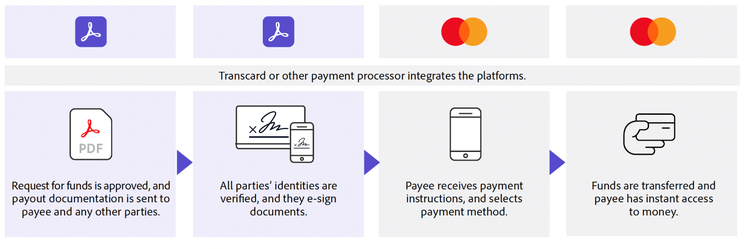

Today, we are announcing the availability of an integrated solution that combines e-signature workflows, powered by Adobe Sign, with instant payment capabilities from Mastercard Send, a payments platform that enables people and organizations to send and receive money in near real-time, domestically and cross-border. The solution enables an end-to-end digital document workflow that includes secure online forms, identity verification, automated document routing for approvals, e-signatures, and instant payments — at a fraction of the cost of paper-based processes and printed checks. Working with a System Integrator, such as Transcard, to integrate Adobe Sign and Mastercard, creates an integrated platform that accelerates approval processes and delivers funds to customers instantly and digitally. This integrated solution will also provide a platform for other System Integrators to build additional payout/disbursement solutions for clients.

From medical reimbursements to tuition and financial aid, approving documents and initiating payments can be lengthy, costly, and complex due to outdated, paper-based processes. Filing insurance claims is another good example of how complicated that work can be. Consumers are spending nearly $2.4 trillion on insurance premiums worldwide, with global travel insurance premiums projected to nearly double from $19.24 billion to $37 billion by 2027*. Claims payments workflows, however, are marred by slow, expensive, and old methods. Printed checks, for example, can take 7 to 10 days to process, when in many cases, financial relief is needed as soon as possible.

Improving document approvals and payment disbursements is the key to customer loyalty and acquisition. Consumers want to receive funds instantly in whatever form they want, wherever they are. At Adobe, we’re focused on helping our partners develop seamless and secure paperless workflows built for today’s digitally savvy customers and Mastercard shares a similar focus.

“In today’s digital world, consumers expect payments to be made in real-time, therefore businesses can no longer afford slow and costly paper processes,” said Chiro Aikat, executive vice president of Products and Innovation for North America at Mastercard. “Through a unique solution that brings together Adobe Sign and Mastercard Send, we’re helping to digitize workflows and speed payments, so people and businesses can receive the funds they need quickly, simply and securely into the financial accounts of their choice.”

Seamlessly and securely process claims for instant payments

The Adobe Sign and Mastercard Send integrated solution helps to enable a secure, end-to-end communication and payment engine that’s easy to integrate within any existing claim management system across insurance, medical reimbursements, financial aid, and government assistance. When it comes to insurance, the top P&C insurance companies use Adobe products like Adobe Sign to provide a seamless experience for policyholders and increase productivity for employees, agents, and brokers, resulting in better customer and employee experiences and significant cost saving in paper and hardware. Insurance companies also rely on Adobe Sign’s extensible APIs and robust integrations with the popular productivity platforms people work in every day like Microsoft, Salesforce, Workday, and ServiceNow.

For example, the Hawaii Employers’ Mutual Insurance Company (HEMIC), Hawaii’s largest provider of workers’ compensation insurance, is helping develop the initial implementation, built by Transcard, to fully digitize its claim management and disbursement processes. Each claimant uploads their documents, which go through a fast, secure, and compliant workflow. The claim is approved for payment or flagged for additional information. Claimants are instantly notified of claim payment instructions, and then select their preferred method for payment. According to HEMIC, the speed of these payments is critical in times like these.

“In the past, processing a benefit payment has been a lengthy and costly process. Immediate access to finances is a lifeline for our customers, especially with the economic trends that we’ve seen throughout the pandemic,” said HEMIC Chief Information Officer and VP Todd Nacapuy. “In addition, more than ever, it is vital to have the most secure and easy-to-use digital tools for our customers and for our organization. The Adobe Sign and Mastercard Send integrated solution is ideal: it transforms the traditional payments of the workers’ compensation world into an instant and safe payment process, with a cost savings of more than 50 percent at HEMIC.”

Digital transformation continues

Transforming insurance approvals and payouts merely scratches the surface of the potential for the Adobe Sign and Mastercard Send integrated solution. Customers, clients, and constituents who must process complex medical reimbursement documents, financial aid applications, and government assistance forms are still struggling through outdated, paper-based processes that are costly, lack transparency, too time-consuming and don’t have the high levels of security required for peace of mind. The Adobe Sign and Mastercard Send integrated solution will continue to transform approvals and payments for customers with the flexibility, simplicity, and speed of digitized workflows.

Learn more here.

- “Aggregate global Travel Insurance premiums are currently valued at USD 19.24 billion and is projected to reach USD 37 billion by 2027” - Global Travel Insurance Market Opportunities and Forecast 2020-2027, Allied Market Research, April 2020

- “Aggregate global P&C insurance premiums are currently valued at USD 2.4 trillion” - Global insurance premiums exceed USD 5 trillion for the first time as pivot east continues, Swiss Re Institute’s latest sigma says, News Release, Swiss Re Group, July 2019