Adobe Digital Economy Index: UK Shoppers set to spend £24.1 Billion Online this Holiday Season, with Deep Discounts and Buy Now Pay Later Fuelling Growth

The holiday season marks a critical period for the retail sector and the UK economy as a whole, with some of the most important dates in our collective calendars. Diwali, Hanukkah, and Christmas are celebrated by tens of millions of people across the UK, each playing host to family gatherings, indulgent feasts and gift giving.

This year, for the first time, the Adobe Digital Economy Index, powered by Adobe Analytics, has forecast how much UK shoppers will be spending online during the 2023 holiday season, when they will be spending the most, and which days will see the deepest discounts for different retail segments. Let’s see what’s in store this year:

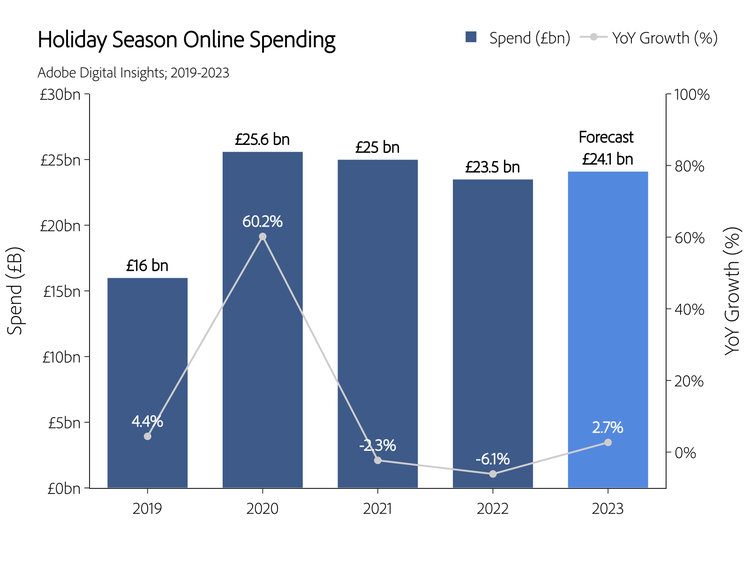

Online Holiday Spending Set To Grow for the First Time in Two Years

The analysis predicts that online spending during the holiday season (Nov 1 to Dec 31) will hit £24.1 billion this year, up 2.7% year-over-year and the first spending growth in two years, since the height of the pandemic. The growth in total spend this year will be driven by retailers stimulating demand through deep discounting and the increased use of flexible payment options, like Buy Now Pay Later (BNPL).

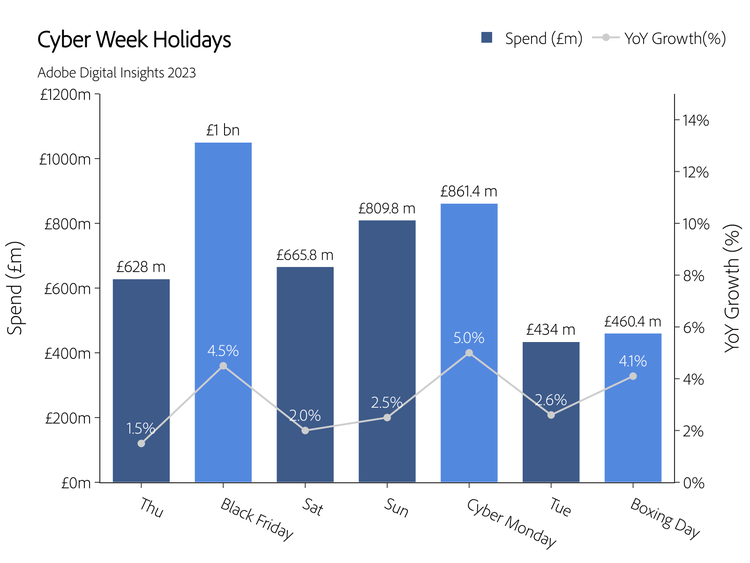

Shoppers Spend Big on Discount Days

The blockbuster discounts on offer during Black Friday and Cyber Monday are expected to break daily spending records for 2023, with Adobe Analytics forecasting £1.05 billion to be spent on Black Friday (up 4.5% year-over-year) and £861.4 million to be spent on Cyber Monday (up 5% year-over-year). Almost £3.4 billion is expected to be spent over the whole of Cyber Weekend.

Cyber Weekend has become a fixture in the shopping calendars of many consumers, with an Adobe survey of 2,000 UK consumers, conducted in October 2023, revealing that more than 1 in 4 UK consumers (28%) will be biding their time to take advantage of the discounts on offer during these major discounting days to help stretch their budgets this year.

And they’re right to do so. Tracking prices of 100 million SKUs online, Adobe Analytics expects Black Friday (24th November) to be the best time to buy apparel, where discounts will peak at 16% off pre-season prices, and toys will be 14% cheaper than pre-season prices.

Saturday 25th November will be the best day to buy TVs (20% cheaper) and computers (22% cheaper); Sunday 26th November will be the best day to buy tools (9% cheaper); and Cyber Monday will be the best day to buy appliances (13% cheaper).

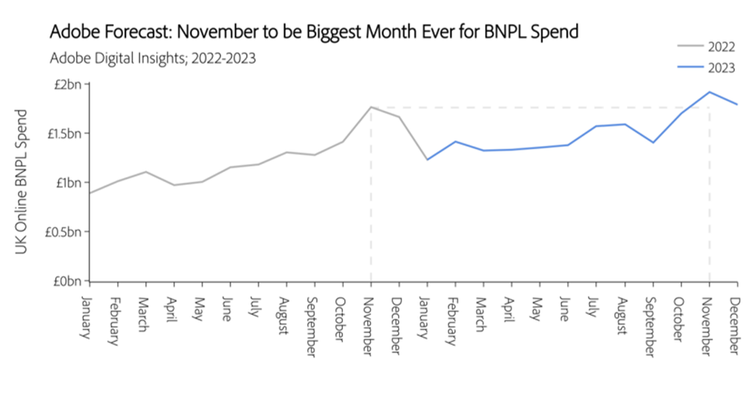

Buy Now Pay Later Boom Continues

Adobe Analytics data reveals that UK consumers have spent £13.5 billion through BNPL services between January and October this year, and expects BNPL spending to reach £3.7 billion this holiday season, accounting for 15% of total holiday spend.

Adobe’s consumer survey found that one in seven shoppers (15%) plan to use BNPL to cover the cost of Christmas gifts this year and two-in-five said they had used BNPL to fund purchases this year.

Cuts Coming To Christmas Food Shop

As with gifting, shoppers are planning to change their shopping habits to get maximum value from their seasonal food shop this year. Our survey reveals that a quarter (25%) are planning to switch away from premium or branded products to store brand or value range alternatives and a quarter (25%) are planning to shop at stores that offer cheaper prices than their usual supermarket. Furthermore, a quarter (24%) of consumers surveyed are also planning to substitute their usual products for different, cheaper items altogether.

TikTok Drives Traffic and Gift Inspiration

TikTok’s growth as a social platform in 2023 is reflected by its growing importance as a channel for retailers. Alongside being a source of gift inspiration for 13% of shoppers, the traffic driven from TikTok to retail sites is expected to grow 135% year-over-year this holiday season, in contrast to the expected traffic from Facebook (down 10% year-over-year) and Instagram (down 15% year-over-year).

You can find more detail on all of these topics and more in the UK Holiday Shopping Forecast Report here.