Adobe Analytics: Consumers spent $76.8 billion online, enticed by early holiday discounts and flexible payment methods (October 2023)

Adobe released its first set of online shopping insights, profiling the pre-holiday season from Oct. 1 to Oct. 31, 2023. In advance of the big shopping days during Cyber Week, Adobe’s data shows that consumers are being strategic in managing their holiday budgets — taking advantage of early deals and leveraging Buy Now Pay Later, a flexible payment method that has seen strong traction this year.

Powered by Adobe Analytics, Adobe provides a comprehensive view into U.S. ecommerce by analyzing direct consumer transactions online. The analysis covers over one trillion visits to US retail sites, 100 million SKUs, and 18 product categories — more than any other technology company or research organization. Adobe Analytics is part of Adobe Experience Cloud, relied upon by over 85 percent of the top 100 internet retailers in the U.S.* to deliver, measure and personalize shopping experiences online.

2023 Holiday Shopping Trends & Insights Report

The holiday shopping forecast is here

Check out this year’s holiday shopping trends and insights — our data-informed guide to consumer spending this season.

Pre-holiday season spend online hits new record

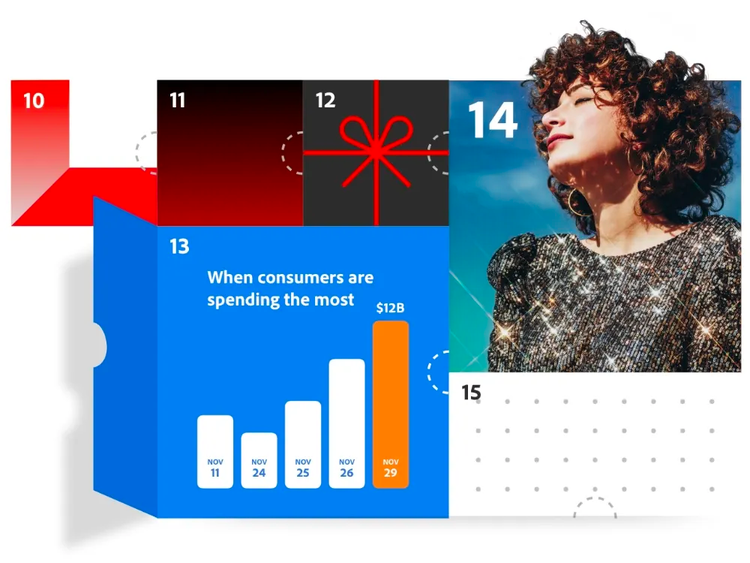

In October 2023, consumers spent $76.8 billion online, up 5.9 percent year-over-year (YoY) and representing $4.3 billion more than the year prior ($72.5 billion spent in October 2022). It also represents a significant 13.6 percent increase compared to the month prior (Sept. 2023). Shoppers were enticed by early discounts offered during promotional events including the second Prime Day, as well as flexible payment methods such as Buy Now, Pay Later (BNPL). Year-to-date (January 2023 to October 2023), consumers have spent a total of $759 billion online, up 4.3 percent YoY.

Early holiday discounts in October caught the attention of shoppers, particularly in categories including electronics and apparel where discounts have been as high as 12 percent and 9 percent, respectively. Shoppers have also seen good deals in sporting goods (7 percent), while more modest discounts were observed in categories including appliances (6 percent), toys (5 percent) and home furniture (5 percent). Looking ahead, Adobe anticipates Cyber Week will again have the best deals this holiday season, with the deepest discounts expected to take place during Black Friday and Cyber Monday.

Shoppers continued to embrace more flexible payment methods, as they look for new ways to manage their holiday budgets this season. BNPL drove $6.4 Billion of online spend in October, up 6 percent YoY. This follows a year where the payment method gathered steam amongst consumers: Year-to-date (January 2023 to October 2023), revenue attributed to BNPL has driven $58.5 Billion, up significantly at 14.5 percent growth YoY. Adobe expects BNPL usage to peak in November and on Cyber Monday.

“We continue to experience a challenging economic picture, where increasing costs for consumers has been seen across rising interest rates, inflation in food prices, resuming student loan repayments, and more,” said Vivek Pandya, lead analyst, Adobe Digital Insights. “Despite the uncertainty in the macro-environment, Adobe Analytics data has shown that the consumer remains resilient heading into the big holiday season and are embracing every opportunity to manage their budgets in more efficient ways.”

Additional Adobe Analytics insights include:

-

Mobile sets new records: Online spending via mobile devices in October 2023 hit a record $35.9 Billion, up a staggering 46.7 percent YoY. Improved mobile shopping experiences have made It easier and more intuitive for consumers to hit buy on smaller screens. Year-to-date (January 2023 to October 2023), spending via mobile has topped $354.7 Billion, up a significant 10.6 percent YoY.

-

Hot Sellers: In October 2023, top selling toys online have included LEGOs, Barbie toys, Squishmallows, art sets, action figures, and stuffed/plush toys. Top electronics have included Bluetooth headphones, smart home and streaming devices, kid’s tablets, and smart watches. Additionally, video gaming devices and games such as the PlayStation 5, Nintendo Switch, Super Mario Bros. Wonder, Marvel’s Spider-Man 2 and Madden 24 have been hot sellers.

-

Categories driving growth: Consumers took advantage of early deals for electronics, with sales for smart home items up 157 percent and electronics accessories up 109 percent, compared to observed levels in September 2023. Additionally, spend on holiday décor items such as Christmas trees, ornaments, and decorations, saw a boost and rose 136 percent as people began to prepare for the upcoming holiday season.

-

Curbside pickup remains steady: In October 2023, this fulfillment method accounted for 18 percent of orders (for retailers who offered the service). This is up slightly from the 17 percent share in October 2022. Adobe expects usage of curbside pickup will increase in December, as consumers leverage it to cut back on shipping costs and avoid shipping delays when making last minute purchases.

Strong consumer spend continues to be driven by net-new demand, and not just higher prices. Adobe’s Digital Price Index shows prices online have fallen consecutively for 14 months (down 6 percent YoY in Oct. 2023). Adobe’s numbers are not adjusted for inflation, but if online deflation were factored in, growth would be 11.9 percent.

Methodology: This report covers the period from October 1 through October 31, 2023. It’s based on Adobe Analytics data and provides the most comprehensive view into US ecommerce by analyzing commerce transactions online. The analysis covers over 1 trillion visits to US retail sites, 100 million SKUs, and 18 product categories. Adobe Analytics is part of Adobe Experience Cloud, which over 85 percent of the top 100 internet retailers in the US* rely upon to deliver, measure, and personalize shopping experiences online.

*Per the Digital Commerce 360 Top 500 report (2021).