Digitizing Claims: The top 5 actions insurance claims leaders need to take to advance digital transformation

Leading claims professionals are faced with rising customer expectations for digital experiences, and routinely challenged with outdated and inefficient internal processes that can’t easily adapt to compete with insurtech competitors. Today, more insurers are rethinking the way they manage claims to elevate client-facing experiences and optimize back-office processing. Here are the top actions they are focused on this year to drive digital transformation:

- Making the claims experience frictionless from end-to-end

A fast, easy, and all-digital claims process is crucial to earning the kind of trust that builds a strong brand and loyal customer base, and digitizing interactions is key to delivering the frictionless experience that claimants expect. Claimants want faster document approvals and instant access to funds. In fact, according to a November 2020 survey commissioned by Adobe and Forrester, “From Challenge to Change: Pandemic survey results from the financial services and insurance industry,” 66 percent of insurance buyers say a seamless experience online would make them most likely to renew with an insurer.

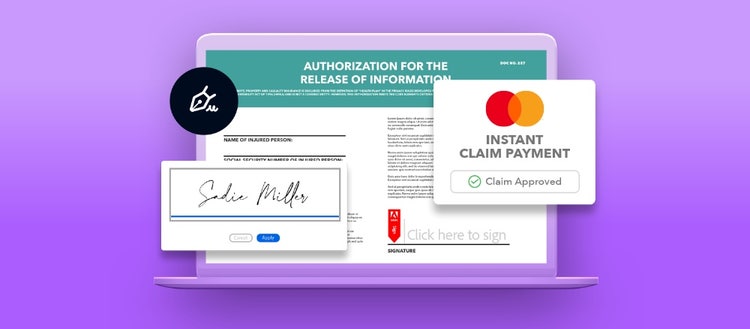

To respond to this demand, claims leaders are integrating solutions to streamline the last mile of claims management by digitizing administration to remove outdated paper-based process and ease the burden on customers filing claims while delivering payments in a quick, secure and digital way.

- Taking a human + digital hybrid approach

The best claims solutions offer choice by designing an efficient hybrid environment that allows person-to-person interaction over your clients’ digital channels of choice. When needed, introducing human touchpoints assures that customers receive the engagement they need the first time, ultimately reducing the cost of servicing requests. The hybrid approach helps increase overall efficiencies while increasing customer satisfaction.

- Implementing straight-through-processing

Insurers continue to focus on advancing straight-through processing. However, on average, fewer than 10 percent of claims are processed straight through in any line. Creating a connected environment and integrating innovative capabilities such as data collection, document management, approvals, signatures, online notarizations and payments can make faster and connected flows without sacrificing customer and employee experiences.

- Analyzing data beyond the claim

Increasingly, claims leaders can use data to understand what customers need and when. While personal privacy is paramount, behavioral analytics and real-time activation help create personalized journeys. Analysis of past claims data may help provide greater insights for future growth with customers.

- Supporting innovation

With the introduction of industry-specific modern technology, such as index trigger-based parametric or usage-based products, insurers need to create a connected and extensible platform to easily deploy and support new technology. Claims platforms need to be able to deliver resolutions which suit the dynamic nature of non-traditional coverage, like flight delay insurance, which credits a customer’s account automatically when their travel is delayed.

Together, Mastercard and Adobe are collaborating to deliver best in class technology solutions for their customers. Through their partnership they have digitized the supporting paperwork and pay-out processes to enable instant, digital disbursements. Mastercard and Adobe are delivering pioneering technology that makes claims disbursement and internal processes simpler, smarter, and safer. Learn more here.

Watch the On-Demand Webinar that shows how Adobe, Mastercard and Transcard can further your insurance organization’s digital transformation efforts.

We would like to recognize Rohit Chhajed and Ruth Polyblank for their contributions to this article.